One of the biggest barriers for most of us, and our kids, when it comes to higher education is the cost. We hear the phrase “financial aid is available” but we’re often not sure where to start.

Fortunately, the availability of financial aid has expanded significantly. Now, many institutions not only accept scholarships and grants that you can obtain from third-party sources, but also offer institutional aid themselves (usually based on parameters such as academic merit, artistic or athletic performance, or community service). Many also offer payment plans, meaning you may be able to borrow less for student loans or avoid taking out loans altogether.

Getting started

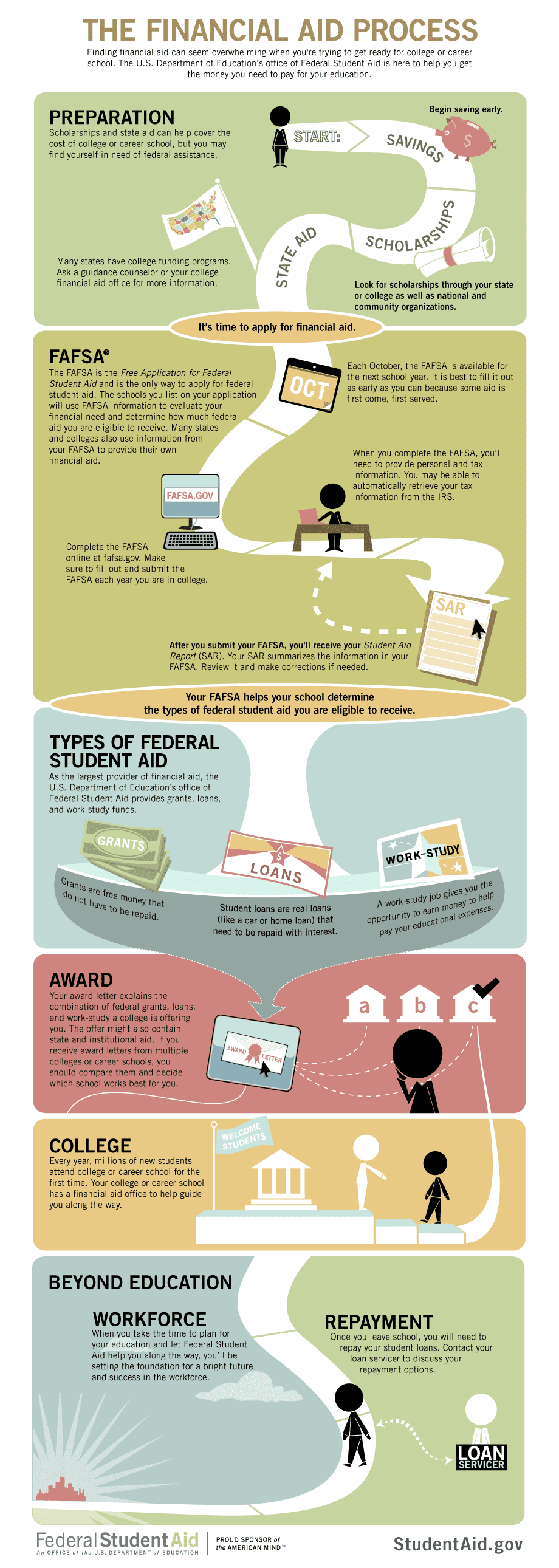

While your college of choice will have their own processes for applying for and securing financial assistance, the first step for applying for any and all college financial aid is to complete the Free Application for Federal Student Aid (FAFSA). Get started at studentaid.gov or use the myStudentAid app.

The financial aid counselors at your prospective school should be able to help you navigate the aid that they know you are eligible to receive after the FAFSA is complete, but it’s a great idea to do your homework as well, because the aid that is available to you can come from multiple sources. Here are just a few examples to help you get started.

Glossary of Terms

Grants – Free money for school that doesn’t have to be repaid. Grants are often based on financial need. (If you withdraw from school mid-semester or do not fulfill grant obligations you may be required to pay back a portion or all of the grant)

Loans – You borrow the money you need and pay it back at a low, fixed interest rate. Loans can be secured in the name of the student or the parents.

Scholarships – Free money for school that doesn’t have to be repaid. Usually awarded based on academic achievement or special talent, trait, or interest. Some scholarships are also targeted toward specific groups of people or backgrounds.

Visit the Federal Student Aid website for a full glossary.

Florida Resident Financial Aid Programs

Being a resident of the Sunshine State has some financial advantages when it comes to college! Check these out:

Florida Bright Futures Scholarships

These academic merit based programs for high school students are the ones that you may have heard about most. Bright Futures awards include the Florida Academic Scholars award, the Florida Medallion Scholars award, the Florida Gold Seal CAPE Scholars award, and the Florida Gold Seal Vocational Scholars award. Get all the specifics here and speak with your child’s high school guidance counselor to find out what he or she may qualify for. {Start early – Bright Futures Scholarships require anywhere from 30 – 100 service hours}

Florida Office of Student Financial Assistance (OSFA)

OSFA, an office of the Florida Department of Education, offers an extensive listing of aid options, including programs such as a matching grant for First Gen students (those whose parents do not hold undergraduate degrees), scholarships for the dependents of farm workers, and family members of disabled or deceased veterans of the U.S. Armed Forces.

Florida Prepaid College Programs

Each year, generally from January or February through the month of April, you probably recall seeing billboards and web ads with a cute little baby wearing a graduation hat, encouraging you to enroll your child in the Florida Prepaid College Program. If you haven’t already, these plans are worth considering. The Prepaid Plans “lock in” today’s tuition rates, so that by the time your child gets to college, a significant amount of their tuition and fees will be covered by the plan. In general, the younger your child is when you purchase a plan, the less money it will cost you per month. You will never lose the money you pay into the plan, even if your child enrolls in a school out of state, opts for a private university, or chooses not to attend college.

Florida Prepaid also offers 529 Savings Plans, which are investment accounts that are subject to market fluctuations, but allow you to put in as much or as little as you like on a regular basis. (Think of it as a 401(k) for college.)

Florida Effective Access to Student Education Grant (EASE )

This is a no-need grant for Florida residents attending an independent, non-profit, private college or university full time in Florida. Each participating institution determines application procedures, deadlines and student eligibility. Formerly the Florida Resident Access Grant or FRAG.

Florida Student Assistance Grant (FSAG)

The FSAG is a state-funded need-based grant for eligible students. Funds are awarded based on full-time enrollment and are subject to eligibility requirements. Must be degree-seeking, resident, undergraduate students who demonstrate financial need and are enrolled in participating postsecondary institutions.

529 Savings Plans

In addition to the plans offered by Florida Prepaid, many independent financial investment firms also offer 529 college savings plans for their clients, so ask your financial representative for advice. You can also read up on how these plans work here.

Federal Work Study (FWS)

FWS is need-based program, so students must meet certain eligibility requirements. FWS usually consists of on-campus employment or work for a local non-profit, with hourly wages paid directly to the student for educational or living expenses. Undergraduate and graduate students can qualify for this program, provided your school offers this program. Visit the DOE Website to learn more.

Aid for Veterans and Their Dependents

There are multiple programs available for active military members, veterans and their dependents. A good place to start to learn about and apply for benefits under the GI Bill is the website for the U.S. Department of Veterans Affairs. To see how your benefits will be applied at your school of choice, call the school’s financial aid department and ask for their Veterans Certifying Official or other authorized representative. Students who participate in the Army Reserve Officers’ Training Corps (ROTC) also qualify for financial aid, and depending on the school, may also receive assistance with living expenses, books and fees, and room and board. Additional scholarships or loans are also available through specific branches of the military and organizations such as the Veterans of Foreign Wars (VFW).

Federal Government Financial Aid

To learn more about government assistance and federal student loans, such as the Parent PLUS Loan, visit studentloans.gov. A variety of need-based federal grants are available from The U.S. Department of Education (ED) for students attending four-year colleges or universities, community colleges, and career schools.

Employer Assistance

If you’re in the market for going back to school, see if your employer offers any tuition assistance or reimbursement programs. Many employers require that you have been employed with them for a certain period of time before benefits can be used, and may have a list of approved fields of study that qualify for benefits. Some employers may require that you remain employed with them for a period of time after your degree is completed, so make sure you find out what all of the policies are before you get started. Some employers also offer a tuition benefit for your spouse or dependents, so check with your supervisor or human resources department.

Scholarships

Scholarships are awarded from a variety of groups, foundations, and institutions. Here are some places to search for scholarships:

- Polk Education Foundation Scholarships – PEF awards over 450 scholarships to High School Seniors in Polk County each year. The online application window opens each January for approximately 3 weeks, and scholarships that require a hard copy application can be found on the website throughout the year. Some scholarships are for a specific school, demographic, or background.

- Financial Aid office at the school where you’ll be attending

- Your high school college & career counselor

- U.S. Department of Labor’s scholarship search tool (look for the filter option to narrow down the list)

- Organizations and Professional Associations related to your field of study

Who to Ask for Help

You don’t have to go it alone! Consider these resources to help you out.

- High School Guidance Counselors – Your student’s high school guidance counselor can be a wonderful resource for help with finding scholarship options and telling your child how, and when, to apply for these opportunities. (Can’t hurt to have another adult besides a parent encouraging them to write yet another essay, right?)

- Your financial representative – If you have any retirement or life insurance accounts through an independent organization, these representatives are often an excellent source of knowledge when it comes to making the right kind of investments for a college savings fund, or helping you find the best options to fund your own education.

- College admission and financial aid counselors – When it comes to finding the best way to afford an education, look to the admission and financial aid teams at your school of choice. They are well versed in how other students are funding their education, they know which institutional aid sources are available, and they can often share tips that you may not have known otherwise.

- Friends who have “been there” – Here’s another way your mom tribe can help… those who have successfully navigated the college process with their kids, or have gone back to school themselves, can help point you in the right direction. Or, if you have little ones and college seems like another lifetime away, you might consider making some lists and dividing up the research to help each other out as you begin to find the best savings options for your kiddos. Or, if none of your mom friends is in the same place you are, ask them for the encouragement you need to keep going… and promise to reciprocate when they’re facing their next life challenge!

Making Cents of it All

Financial aid research can feel overwhelming, but take it one step at a time. We’ve just skimmed the surface of the many options that are available to you and your kids, so use this as a starting point for your own journey. The many schooling options here in Lakeland alone are definitely worth the effort! Visit our post on Colleges & Technical Schools in Lakeland to learn more.

Source: StudentAid.gov

Education Guide

Check out our Education Guide for Lakeland + Polk County for other education topics including public schools, private schools, homeschooling, tutoring + test prep, school calendars, colleges, and more.

About the Author: Stephanie Curl, Contributing Writer

Stephanie is a writer and editor and has worked in the marketing field for her entire career. She has lived in Lakeland since 2005 and loves the family-friendly activities and sense of community that Lakeland offers. Stephanie is married to her high school sweetheart, Edward, and they have two young daughters. She loves classic literature and anything related to Harry Potter…and she’s always up for another cup of coffee!